President Bola Ahmed Tinubu has nominated Olayemi Cardoso as the new governor of the Central Bank of Nigeria (CBN), along with four deputy governors: Emem Nnanna Usoro, Muhammad Abdullahi Dattijo, Philip Ikeazor, and Bala M. Bello.

The nominees are awaiting confirmation by the Senate, which is expected to resume from its recess in October.

The CBN is the apex bank of Nigeria, responsible for monetary policy, financial stability, currency management, and banking regulation. According to the CBN Act 2007, the bank’s board of directors comprises the governor, who is the chairman, four deputy governors, the permanent secretary of the ministry of finance, five directors, and the accountant general of the federation.

The nominees have a combined experience of over 130 years in financial services, economics, and public policy. Here is a brief profile of each of them:

-

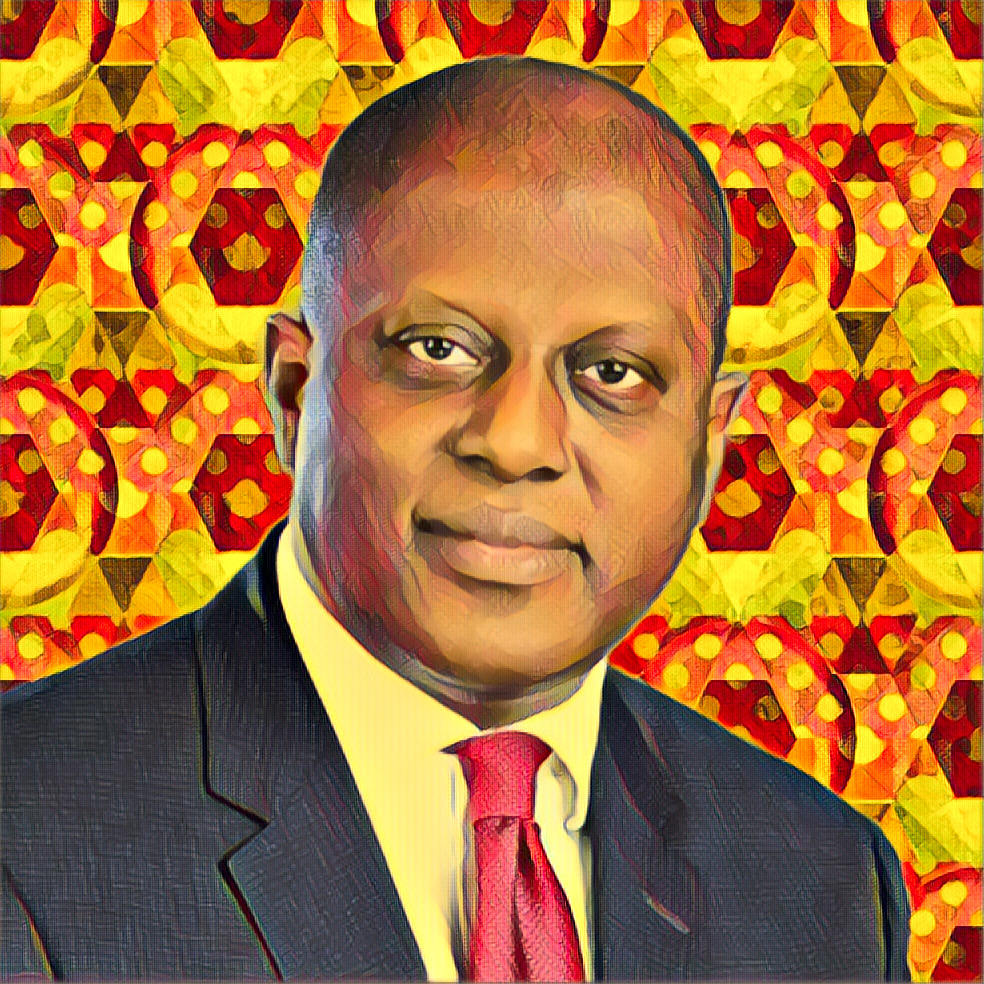

Olayemi Cardoso: He is a seasoned banker and economist with over 30 years of experience in both the public and private sectors. He served as the commissioner for economic planning and budget in Lagos State from 1999 to 2007, where he oversaw the implementation of several reforms and projects. He also served as the chairman of Citibank Nigeria from 2010 to 2019, where he led the bank’s growth and expansion in Africa’s largest economy. He holds a bachelor’s degree in economics from Harvard University and a master’s degree in development economics from Oxford University.

-

Emem Nnanna Usoro: She is a banker with over 20 years of experience spanning retail, commercial, corporate banking, and the public sector. She currently holds the executive director position at United Bank for Africa (UBA), overseeing the bank’s northern operations. She has also held various leadership roles at Ecobank Nigeria, Standard Chartered Bank Nigeria, and Diamond Bank. She holds a bachelor’s degree in accounting from the University of Calabar and a master’s degree in business administration from the University of Lagos.

-

Muhammad Abdullahi Dattijo: He is a development economist with over two decades of experience in policy formulation, public finance, and project implementation. He has served in various positions, including as a policy adviser at the United Nations Secretary-General Ban Ki-Moon Executive Office in New York. In this role, he was a core team member that designed the Sustainable Development Goals (SDGs). He also serves as a World Bank Expert Advisory Council member on citizen engagement. He holds a bachelor’s degree in economics from Ahmadu Bello University and a master’s degree in development studies from the London School of Economics.

-

Philip Ikeazor: He is a chartered accountant and banker with over 25 years of experience in audit, risk management, corporate governance, and financial advisory. He is currently Keystone Bank Limited’s executive director, overseeing the bank’s operations and strategy. He has also worked as a partner at KPMG Nigeria, leading several audit and advisory engagements for clients across various sectors. He holds a bachelor’s degree in accounting from the University of Nigeria and a master’s degree in finance from the University of London.

-

Bala M. Bello: He is a banker with over 30 years of experience in the financial services industry. He has held various board positions, notably as the CEO of Keystone Bank Limited, CEO of Ecobank Kenya Limited, executive director of Union Bank Nigeria, director of Union Bank UK PLC, and director of Orient Bank Uganda. He is currently the executive director of corporate services at the Nigerian Export-Import Bank appointed by President Buhari. He holds a bachelor’s degree in business administration from Ahmadu Bello University and a master’s degree in banking and finance from Bayero University.

The nominees are expected to bring their wealth of experience and expertise to bear on the CBN’s challenges, such as inflation, exchange rate volatility, low foreign reserves, banking sector fragility, and economic recovery.