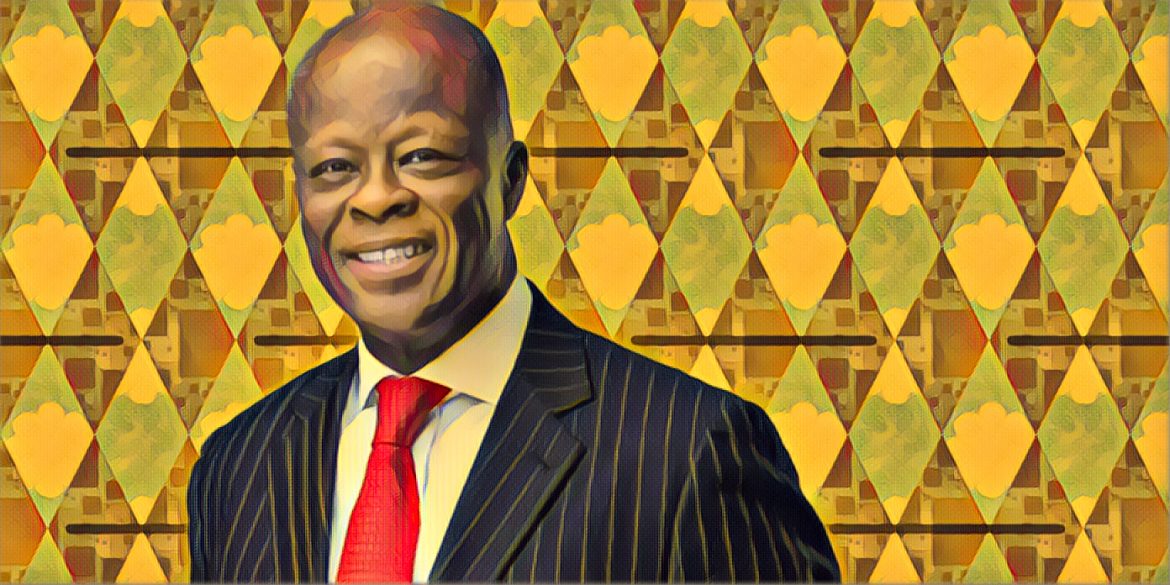

According to Tope Fasua, the Special Adviser to the President on Economic Affairs, Nigeria’s foreign exchange market desperately needs structural reforms. He has proposed that the Central Bank of Nigeria (CBN) drastically reduce the number of Bureau de Change (BDC) operators in the country from over 5,000 to about 200.

Fasua, a renowned economist and CEO of Global Analytics Consulting, suggested this at an economic policy event organized by the Abuja Chamber of Commerce and Industry. The theme was “Unification of foreign exchange and the effect of fuel subsidy removal on the business community.”

He argued that the high number of BDCs makes it difficult for the CBN to supervise them, leading to irregularities and inefficiencies in the forex market. He said Nigeria should emulate countries like the United Kingdom and the United Arab Emirates, which have fewer than 200 BDCs each.

“We need to do some structural reforms. For example, let’s reform the BDCs sector and make it stronger. You can’t manage over 5,000 BDCs selling money on the streets, which is not normal,” Fasua said.

He added that the CBN should incentivize the BDC sector and banks to provide forex to Nigerians more quickly and transparently. He also called for the definition of the illegal forex market in order to achieve stability in the official market.

“You have to define the illegal market, and by then, we will be able to find stability,” Fasua said.

Fasua’s call comes when Nigeria is grappling with a forex crisis. The naira has depreciated sharply against the US dollar recently, and businesses are struggling to access forex. The CBN has taken a number of measures to address the forex crisis, including restricting the sale of forex to BDCs. However, these measures have not been very effective so far.

Some analysts have welcomed Fasua’s proposal, saying that it could help improve the forex market’s efficiency and transparency. They also said it could reduce the pressure on the foreign reserves and ease the exchange rate volatility.

However, some stakeholders have expressed concerns about the possible implications of reducing the number of BDCs. They said it could create a monopoly for a few operators and lead to higher prices for forex. They also said that it could affect the livelihoods of thousands of Nigerians who depend on BDCs for their income.

Whether the CBN will heed Fasua’s call to reduce the number of BDCs remains to be seen. However, his proposal is worth considering, as it could help to address one of the biggest challenges facing Nigeria’s economy.

Source: BusinessDay