Nigerian brewers face tough times as the country’s foreign exchange crisis has doubled their finance costs. This, coupled with rising inflation and supply chain disruptions, is putting a strain on their businesses and making it difficult for them to remain profitable.

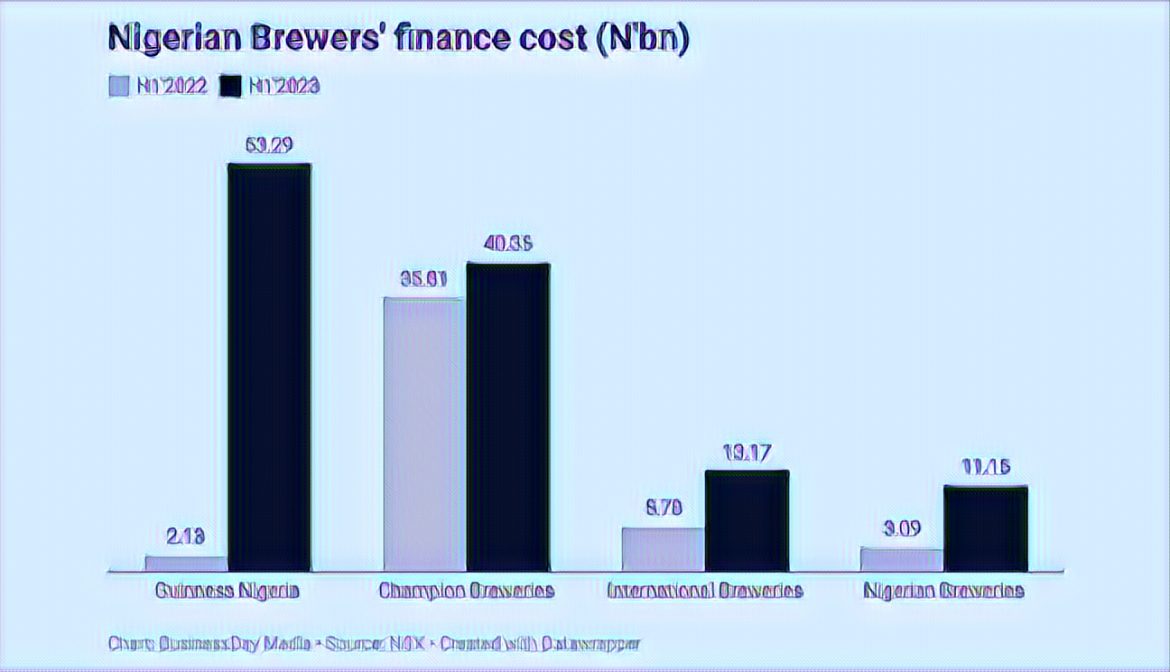

Nigerian beer makers recorded a 152 percent surge in finance cost to N117.96 billion in the first half of 2023 from N46.81 billion in the year-ago period, according to BusinessDay’s calculations. This means they spent more money on servicing their debts, which were mostly denominated in foreign currencies.

Guinness Nigeria recorded the highest increase of 2401.9 percent growth, Nigerian Breweries followed with a record of 260.8 percent growth, International Breweries reported 127.9 percent year-on-year growth while Champion Breweries recorded a 12.7 percent increase.

“The biggest problem for a lot of consumer goods firms are FX losses because a lot of them have USD liabilities to import raw materials on credit, and as they have their debt as books, they need to convert it to naira,” Ayorinde Akinloye, an investor relations analyst at Seplat Energy Plc, said.

He told BusinessDay that brewers had higher cost problems, an inflation environment and the impact of raw materials cost, price of goods, and other raw materials they use on their cost and profit.

“FX pressure is the biggest impact on their performance. Inflation and FX are the two problems because as inflation affects them, they also increase prices,” he said.

The naira has lost more than 30 percent of its value against the US dollar since January 2023, when the Central Bank of Nigeria (CBN) devalued it from N306 to N360 per dollar. The official exchange rate is now N410 per dollar, while the parallel market rate is around N570 per dollar.

This has made it more expensive for brewers to import raw materials such as barley, malt, hops, and packaging, which account for about 70 percent of their production costs. According to the National Bureau of Statistics (NBS), the inflation rate in Nigeria was 18.12 percent in April 2023, the highest in four years.

The brewers have tried to pass on some of the costs to consumers by increasing the prices of their products, but this has also affected their sales volume and market share, as many Nigerians have reduced their spending on discretionary items due to the economic downturn.

The COVID-19 pandemic has also affected the demand for beer, as social gatherings and entertainment venues were restricted or shut down to curb the spread of the virus. The CBN reported that the manufacturing sector contracted by 1.51 percent in 2020, with the food, beverage, and tobacco subsector declining by 2.57 percent.

Despite these challenges, some brewers are optimistic that they can overcome the difficulties and improve their performance in the year’s second half. They are also exploring ways to reduce their dependence on imported inputs and increase their local sourcing of raw materials.

For instance, Guinness Nigeria said it had increased its local sourcing of raw materials from 55 percent in 2019 to 75 percent in 2020 and aimed to achieve 100 percent by 2024. Nigerian Breweries said it had invested in backward integration projects such as cassava and sorghum farming to support its production.

The brewers also hope the government will provide relief measures such as tax incentives, lower interest rates, and stable exchange rates to help them cope with the harsh operating environment.

Source: BusinessDay