In a bold move to combat surging inflation, the Central Bank of Nigeria (CBN) recently undertook significant monetary policy adjustments. The bank’s decision to increase the Monetary Policy Rate (MPR) by a substantial 400 basis points to 22.75% from 18.75% marks a decisive action against the backdrop of escalating inflationary pressures within the country. This adjustment exceeded the expectations of many financial analysts, who had anticipated a more modest tightening of monetary policy.

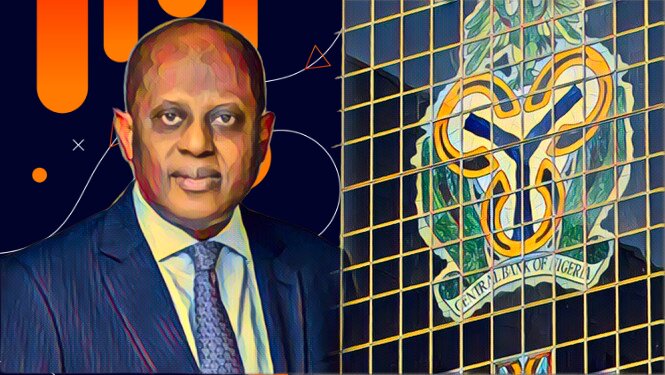

Alongside the MPR hike, the CBN also revised the asymmetric corridor around the MPR to +100/-700 basis points and elevated the Cash Reserve Requirement (CRR) to 45% from 32.5%, while maintaining the Liquidity Ratio at 30%. These measures were unveiled by CBN Governor Olayemi Cardoso during a press briefing following a two-day meeting of the Monetary Policy Committee (MPC), signaling a rigorous approach to reining in the inflation rate, which stood at 29.90% in January.

The significant increase in policy rates is aimed at mitigating inflationary pressures and stabilizing the nation’s economy. Cardoso highlighted the central bank’s further disbursement of $400 million to address outstanding foreign exchange commitments and justified the CBN’s stringent stance on cryptocurrency platforms, emphasizing the need to protect the Nigerian economy from speculative activities that could undermine the naira.

The MPC’s decisions reflect a strategic balancing act between fostering economic growth and curbing inflation. With a transition to an inflation-targeting framework, the CBN is prioritizing the establishment of a stable and low-inflation environment as a foundation for sustainable economic expansion. Cardoso underscored the dilemma faced by the MPC, choosing to escalate the policy rate over maintaining the status quo to more effectively anchor inflationary expectations.

The MPC’s deliberations also touched upon the distortions in the foreign exchange market, attributed to speculative activities. Cardoso expressed optimism that ongoing reforms, including market unification and transparency initiatives, would alleviate these pressures and contribute to a more stable economic landscape.

Furthermore, Cardoso addressed the improvement in the country’s gross external reserves, attributing it to the positive impacts of foreign exchange market reforms and increased oil production. He emphasized the central bank’s commitment to monetary stability and inflation control as critical to restoring investor confidence and facilitating economic recovery.

The CBN’s assertive monetary policy adjustments have sparked debate among economists and industry stakeholders. The Centre for the Promotion of Private Enterprise (CPPE) warned that the sharp increase in the MPR and CRR could adversely affect the real sector, which is already grappling with multiple macroeconomic challenges. The CPPE’s Chief Executive Officer, Dr. Muda Yusuf, highlighted the potential repercussions on the cost of credit and the banking sector’s ability to support economic growth.

Yusuf’s critique underscores the unique challenges facing Nigeria’s economy, where inflation is driven more by supply-side factors and fiscal policies rather than purely monetary dynamics. The CPPE’s stance reflects concerns that traditional monetary tightening may not be the most effective tool for addressing Nigeria’s specific inflationary pressures.

Amid these policy shifts, the Manufacturers Association of Nigeria (MAN) advocated for the government and the CBN to provide single-digit credit facilities to the manufacturing sector, emphasizing the critical role of manufacturing in economic development. MAN’s call for targeted financial support highlights the broader need for holistic policy measures that address both monetary stability and the structural underpinnings of economic growth.

As Nigeria navigates through these economic challenges, the CBN’s aggressive stance on inflation and monetary stability underscores a commitment to restoring economic equilibrium. However, the effectiveness of these measures and their impact on the broader economy will depend on a delicate balance between monetary tightening and supportive fiscal policies. The ongoing dialogue between policymakers, industry stakeholders, and the financial sector will be crucial in shaping a sustainable path toward economic recovery and long-term growth.

Source: This Day Live