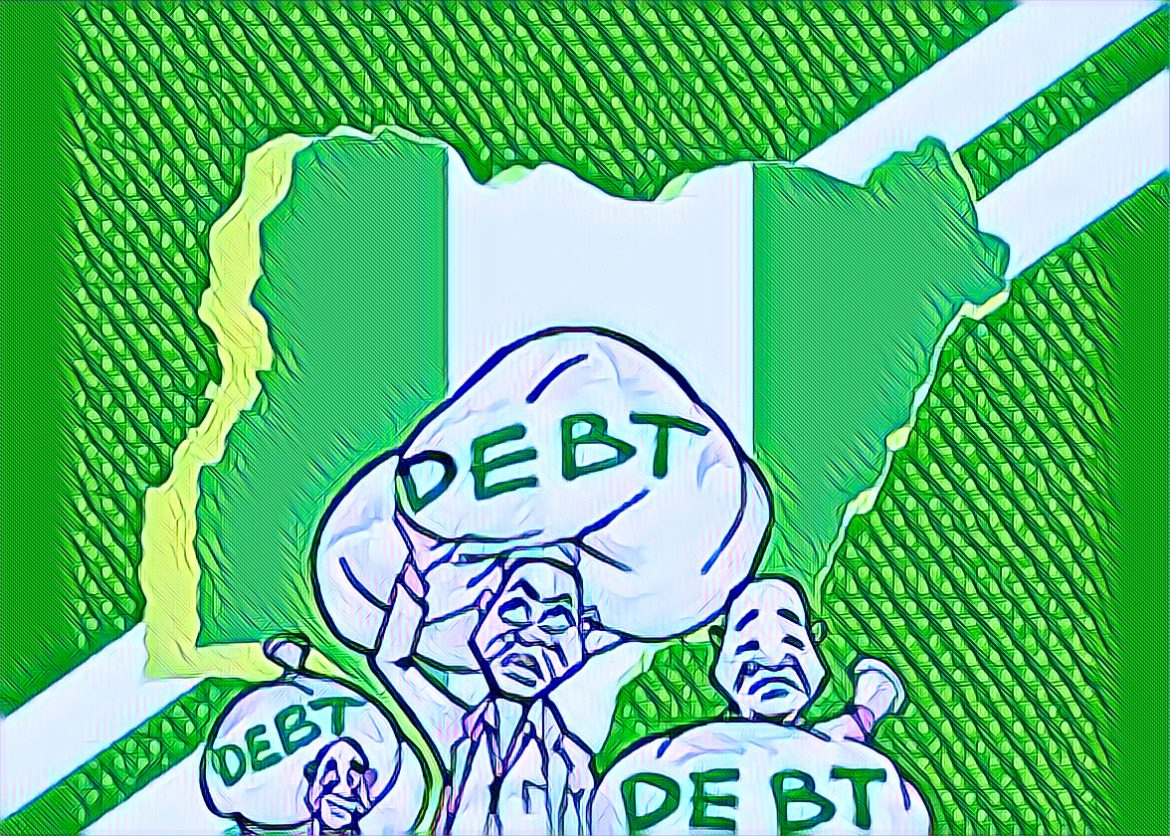

Nigeria’s financial health is under scrutiny as debt repayment obligations surpass both recurrent and capital expenditures. This alarming trend has sparked concerns about the country’s economic stability and long-term growth prospects.

The Center for the Promotion of Private Enterprise (CPPE) recently revealed that Nigeria’s debt service costs have now exceeded its combined spending on recurrent and capital expenses. This means a significant portion of the nation’s revenue is being funneled towards paying off debt, leaving less for essential services and infrastructure development.

Nigeria’s debt situation has been steadily worsening over the past decade. According to the Debt Management Office (DMO), the country’s total public debt reached N46.25 trillion by the end of 2023, up from N32.92 trillion in 2021. This increase is partly due to the government’s borrowing to finance budget deficits and fund critical infrastructure projects. However, the rising debt service costs are straining the national budget.

Dr. Muda Yusuf, Director of the CPPE, expressed concerns over the sustainability of Nigeria’s debt levels. “When debt service obligations exceed critical government spending, it poses a severe risk to economic stability and growth,” Yusuf said. He emphasized that the government needs to adopt more sustainable fiscal policies and improve revenue generation to manage the debt burden effectively.

The recurrent expenditure, which includes salaries, pensions, and operational costs of government agencies, and capital expenditure, which covers investments in infrastructure, education, and health, are both being overshadowed by the need to service debt. For instance, in the 2024 budget, debt service was allocated N11.34 trillion, whereas capital expenditure received N4.8 trillion and recurrent expenditure N8.3 trillion.

This fiscal imbalance has several implications. First, it limits the government’s ability to invest in critical infrastructure projects needed to stimulate economic growth. Second, it puts pressure on public services, as funds that could be used for healthcare, education, and social welfare are diverted to debt repayment. Third, it reduces the country’s fiscal space to respond to economic shocks and crises.

To address this growing concern, economic experts have suggested several measures. One is enhancing revenue mobilization through improved tax collection and broadening the tax base. Currently, Nigeria’s tax-to-GDP ratio is one of the lowest in the world, hovering around 6%. Increasing this ratio would provide the government with more funds to meet its obligations without excessive borrowing.

Another recommendation is to reduce waste and improve efficiency in government spending. Corruption and inefficiency have been persistent issues in Nigeria’s public sector, leading to the misallocation of resources. Strengthening institutions and implementing robust financial management practices could help address these problems.

Moreover, diversifying the economy is crucial. Nigeria’s economy is heavily reliant on oil exports, which makes it vulnerable to fluctuations in global oil prices. By developing other sectors such as agriculture, manufacturing, and technology, the country can create more stable revenue streams and reduce its dependence on oil.

The government is also being urged to renegotiate existing debt agreements to secure more favorable terms. This could involve extending repayment periods, reducing interest rates, or even seeking partial debt forgiveness from international creditors. Such measures could provide temporary relief and help manage the debt burden more effectively.

Despite these challenges, there are signs of hope. Nigeria has a young and dynamic population, abundant natural resources, and a growing entrepreneurial sector. By implementing sound economic policies and focusing on sustainable development, the country has the potential to overcome its debt challenges and achieve long-term growth.

As Nigeria grapples with its debt repayment crisis, the need for comprehensive fiscal reform and prudent economic management has never been more critical. The country’s future prosperity hinges on its ability to balance debt obligations with essential investments in infrastructure and public services.

Source: tribuneonlineng.com