KEY POINTS

- CBN hikes up the MPC to 27.25 percent, by a 50 basis points boost.

- The Cash Reserve Ratio for deposit money banks was increased to fifty percent.

- Financial pundits expected rate hold or rate cut because of the declining inflation rates.

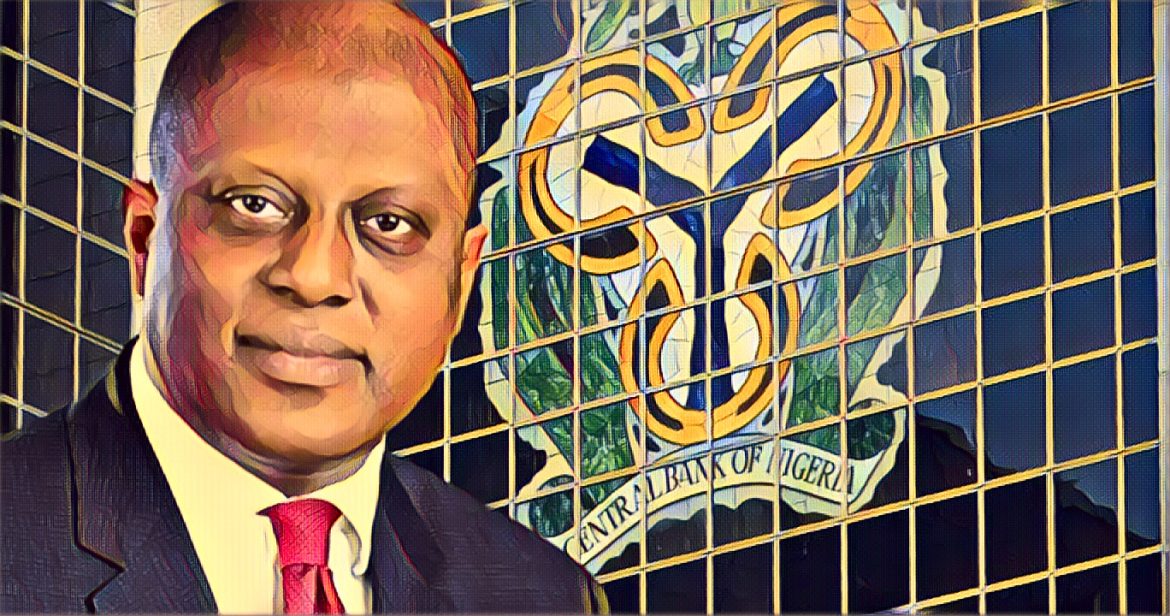

The CBN’s Monetary Policy Committee (MPC) has raised the Monetary Policy Rate (MPR) to 27.25 percent. This decision came after the committee’s fifth meeting of the year, held at the CBN headquarters in Abuja. CBN Governor Olayemi Cardoso implemented this decision on Tuesday.

The new rate represents a 50 basis points increase from the previous 26.75 percent announced in July 2024. Over the past year, the current leadership has increased interest rates by 8.5 percent. This hike is aimed at controlling inflation and restoring stability in the economy.

Tightening of monetary policy

Governor Cardoso emphasized the need for stricter monetary policies to maintain economic stability. He stated, “The decision to continue this approach was unanimous among committee members, which led to the MPR increase.”

Additionally, the MPC decided to retain the asymmetric corridor around the MPR at +500 to -100 basis points. The Cash Reserve Ratio (CRR) for deposit money banks was raised from 45 percent to 50 percent. The CRR for merchant banks increased from 14 percent to 16 percent. The liquidity ratio remained unchanged at 30 percent.

Market reaction and expert opinions

According to the reports from Punch, financial experts had predicted that the CBN would either hold or cut interest rates. This expectation was based on two consecutive months of declining headline inflation. However, the decision to raise rates reflects concerns about economic volatility both locally and globally.

In the MPC’s statement, Governor Cardoso acknowledged positive inflation trends but highlighted the importance of addressing inflationary expectations. He stated that a predetermined contractionary effect was necessary to manage monetary conditions effectively.