KEY POINTS

- To eliminate the difference between the official and black market exchange rates, CBN has liberalized the naira.

- Governor Cardoso focuses on credibility as the most important factor in effective monetary policy.

- Recent inflation trends show a positive direction in economic stability.

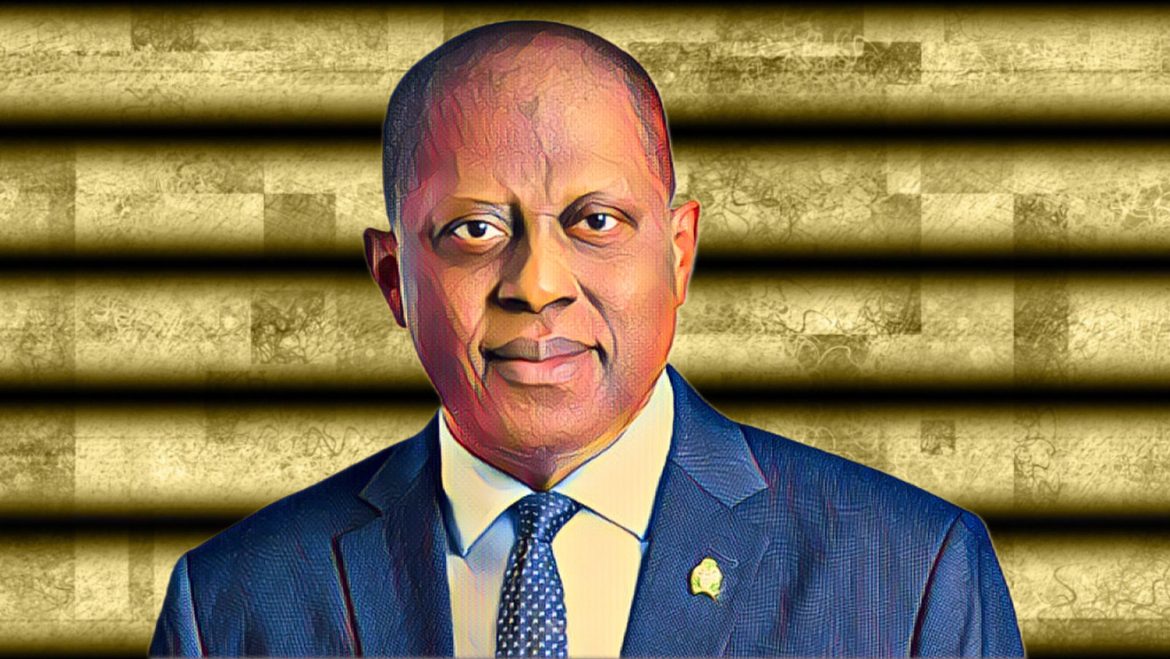

Speaking at a recent news conference, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, stood his ground on the decision to liberalize the naira in order to close the differential between the official and the black market rates.

At a forum organised by the Harvard Club of Nigeria in Lagos, Cardoso stressed that credibility and accountability are the key issues in the financial industry. He pointed out that the official rate should be brought into conformity with the market condition so that arbitrage and speculation, which had dented confidence in the foreign exchange market, could be curbed.

Floating the Naira: Cardoso’s rationale

Cardoso’s immediate predecessors at the CBN had shunned floating the naira because of its potential to depreciate drastically and create unfavourable macroeconomic conditions. But Cardoso said the difference between the official rate and the parallel market rate encouraged ‘hot’ money and eroded confidence. He admitted that the policy attracted a lot of flaks but he said that it was necessary to regain the confidence of the Nigerian financial markets.

“Credibility is earned by consistency,” Cardoso said, adding that, despite the fact that the CBN decision could not but bring about short-term pain, it helped the audience to get a clear understanding of what the CBN is capable of and what it intends to do in terms of monetary policy.

Inflation management and interests rates changes

Speaking on inflation, the CBN Governor, Mr. Cardoso said that the bank has been in the process of taming inflation and has in recent time made some moves that show a positive direction. He pointed out that according to the National Bureau of Statistics, inflation rates were falling in July and August 2024 which means that the central bank’s policies were starting to work. However, Cardoso noted that the CBN had not fully achieved its inflationary objective, but he was hopeful about the economic policy direction.

He also had a chance to elaborate on the decision to increase the Monetary Policy Rate (MPR) to 27.25%, saying it was a courageous step, but one that had to be taken. Higher interest rates are used to reduce the amount of money in the economy and therefore assist in finding ways of reducing inflation.

According to Vanguard, Cardoso agreed that the decision affected borrowers but said that sometimes, one had to do what was right for the future as opposed to what was easy in the present. ”Leadership is all about taking difficult decisions to ensure the future stability,” he said.

Cardoso’s plans to rebuild the credibility and sustainability of the CBN are directed at strengthening its position as a stabilizer of Nigeria’s economy. Based on this leadership approach, he seems to be focused towards solving some of the long outstanding problems in the exchange rate system and enhancing the overall economic stability.