KEYPOINTS

- Nigeria is set to deliver 400,000 barrels of crude daily to Dangote.

- The deal will significantly reduce Nigeria’s crude oil exports.

- Dangote Refinery nears full capacity, aiming to reduce fuel imports.

Nigeria’s Federal Government is set to deliver 400,000 barrels of crude oil daily to the Dangote Refinery under the naira-for-crude deal.

This agreement, expected to last over the next two months, will result in the supply of 24 million barrels of Nigerian crude between October and November 2024.

The deal marks a significant shift in Nigeria’s crude oil supply chain, impacting the local oil industry and export markets.

Boost to local crude processing

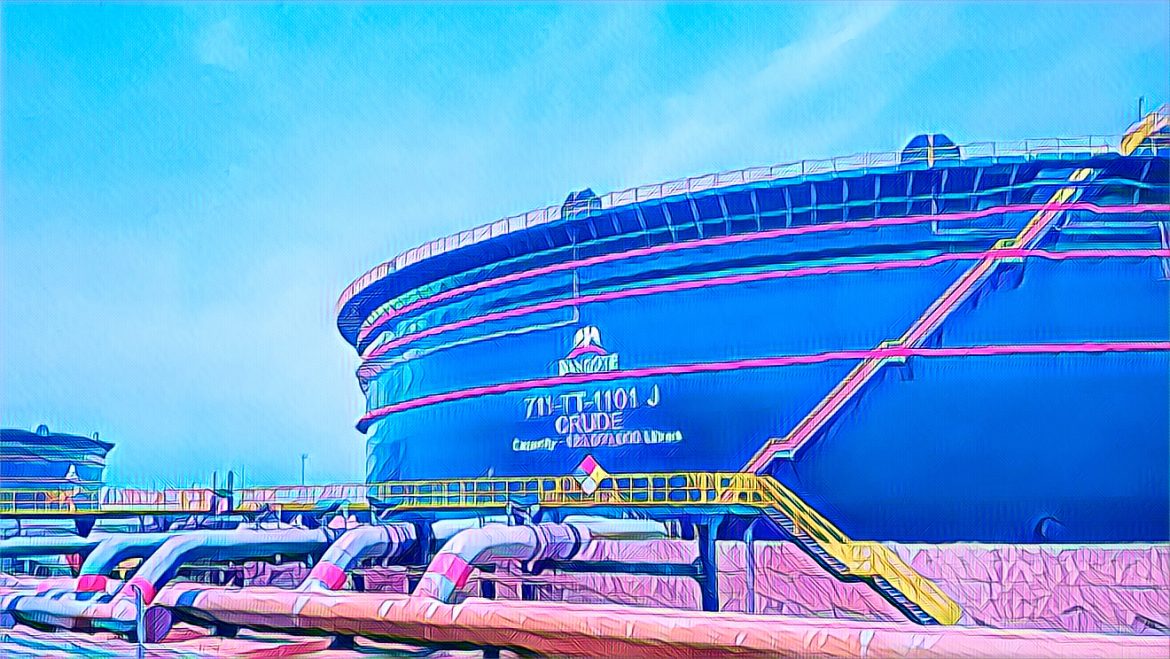

The Dangote Refinery, which has a capacity of 650,000 barrels per day, is the largest in Africa and Europe.

This increased supply of local crude will allow the refinery to meet more of the country’s demand for refined petroleum products, reducing reliance on imported fuel.

The Nigerian National Petroleum Company Limited (NNPC) has been tasked with supplying crude to the Dangote Refinery and three other refineries, which are set to begin producing Premium Motor Spirit (PMS).

By using local crude as feedstock, Nigeria aims to cut its oil product imports, leading to significant savings for the country’s economy.

Impact on crude exports and market

Dangote’s increasing dependence on local crude will affect Nigeria’s crude exports, particularly to the Atlantic oil market.

According to cargo allocations reviewed by Bloomberg News, the refinery’s operations will claim 13 to 14 shipments from Nigeria’s typical monthly program of about 50 cargoes. As a result, Nigeria’s crude exports are expected to fall, possibly going below 1 million barrels per day.

Ronan Hodgson, an analyst at FGE, noted that the West African crude market will become “substantially tighter” in the fourth quarter of 2024 due to the supply allocated to Dangote.

This shift could disrupt global oil markets, tightening crude availability in the region.

The deal could also affect other international markets, as Dangote has reduced its reliance on U.S. crude imports, including West Texas Intermediate (WTI) Midland.

According to Punch, the refinery had previously imported millions of barrels of U.S. crude but has scaled back purchases due to increased local supply.

Refinery’s ramp-up nearing full capacity

The Dangote Refinery, which is currently running at 60-70 percent capacity, is expected to reach full production capacity soon.

Vartika Shukla, Chairman of Engineers India Ltd., the project management firm, stated last month that the refinery’s full ramp-up is expected within months. Once fully operational, the refinery could play a critical role in Nigeria’s long-term goal of reducing costly fuel imports.

Nigerian National Petroleum Co. recently finalized an agreement with Dangote, under which NNPC will supply crude to the refinery in exchange for exclusive rights to distribute gasoline produced at the plant.

This arrangement positions Dangote as a key player in Nigeria’s fuel production and distribution system.

As Dangote continues its ramp-up, Nigeria is on the verge of achieving a long-sought goal of reducing oil product imports.

According to Hodgson, “If the refinery runs at higher rates, the West African market for gasoline and diesel imports will shrink extremely quickly.”