KEY POINTS

-

Nigeria exits the Financial Action Task Force (FATF) grey list after meeting global compliance standards.

-

Tinubu calls the delisting a major step for Nigeria’s financial credibility.

-

Experts say the move will attract more investment and strengthen cross-border transactions.

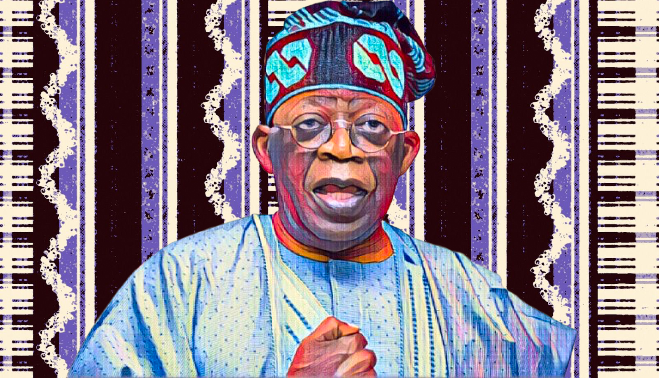

Nigeria has officially exited the Financial Action Task Force (FATF) grey list, a development President Bola Tinubu described as a major stride for the country’s economy and governance standards. The global watchdog on money laundering and terrorist financing announced Nigeria’s removal at its October 2025 plenary in Paris, following the full implementation of a 19-point reform plan that strengthened the nation’s financial crime framework.

Tinubu said in a statement issued by his Special Adviser on Information and Strategy, Bayo Onanuga, that the exit was more than a technical milestone. He called it a “strategic victory for our economy and a renewed vote of confidence in Nigeria’s financial governance.” Nigeria had been placed on the FATF grey list in February 2023 for weak enforcement and poor inter-agency coordination.

Key reforms drive Nigeria’s FATF exit

The President said his administration viewed the grey-listing as a challenge that required immediate action. He directed key institutions to carry out legal and institutional reforms to meet FATF standards. The Nigerian Financial Intelligence Unit (NFIU), working with the Offices of the Attorney-General and the Ministers of Finance, Justice, and Interior, led the process of compliance.

Tinubu commended the NFIU’s Director and Chief Executive Officer, Hafsat Bakari, and her team for what he called a “diligent and timely execution” of Nigeria’s obligations. Bakari confirmed the country’s removal from the FATF watchlist, describing it as proof of Nigeria’s resilience and its determination to uphold global standards.

She cited major reforms that included the enforcement of the Money Laundering (Prevention and Prohibition) Act 2022 and the Terrorism (Prevention and Prohibition) Act 2022. Other achievements included the launch of the Beneficial Ownership Register and tighter regulation of non-financial businesses and professions.

Nigeria exits FATF grey list strengthens investor confidence

According to Punch, Bakari said Nigeria had also expanded the capacity of its law enforcement and intelligence agencies to investigate and prosecute financial crimes. She noted that cross-border cooperation had improved significantly, helping the country detect illicit financial flows.

Tinubu praised the National Assembly, the judiciary, and the private sector for supporting the reforms. He said Nigeria would continue to institutionalise compliance and sustain the credibility gained through the FATF process.

At the same FATF plenary, South Africa, Mozambique, and Burkina Faso were also removed from the grey list after similar progress in strengthening their financial systems. Analysts believe Nigeria’s delisting will reduce transaction bottlenecks, boost investor confidence, and enhance access to global financial networks.

Tinubu said the development marked a new phase in Nigeria’s economic reform agenda.

Tinubu said the development marked a new phase in Nigeria’s economic reform agenda. “We will deepen collaboration and build a financial system that Nigerians and the world can trust,” he said.