KEY POINTS

- IFC loan to Justrite would support a 25-store expansion.

- Rising energy costs pushed the retailer to adopt solar upgrades.

- AfricInvest’s stake helped strengthen operations ahead of growth.

Justrite is preparing for another round of growth as the International Finance Corporation reviews a naira-equivalent loan of up to $15 million for the Nigerian supermarket chain founded by Ayodele Patrick Aderinwale and his wife. The proposed financing appears in IFC’s investment pipeline and would support a large store rollout that pushes the retailer outside its southwest footprint. What began as a single neighborhood shop in 2000 has become one of the country’s most recognizable domestic retail names, serving busy urban districts and fast-growing communities that have lacked access to modern supermarkets.

IFC loan to Justrite backs wider reach

IFC’s filing shows the funding would help cover new construction, equipment purchases, and hiring. It would also strengthen links with the local suppliers that account for most of the goods on Justrite shelves. Should IFC approve the loan, it would rank among the notable development-finance commitments directed at Nigeria’s formal retail space in recent years.

Rising power and logistics costs have pressured retailers across the country, and the strain intensified following the 2022 jump in fuel and electricity prices. Justrite absorbed a steep climb in energy expenses during that period and responded by installing solar systems and introducing energy-saving upgrades in selected stores. The IFC facility is expected to extend these investments, helping shift the chain toward more predictable and efficient operations.

Opening 25 new locations will require improvements in warehousing, transport routes, cold-chain capacity, and digital inventory systems. AfricInvest, which acquired a 40.4 percent stake in 2022, has worked with the company on procurement processes and operational reforms, sharpening governance as Justrite prepared for rapid scale.

Expansion needs grow with IFC loan to Justrite

Nigeria’s population growth continues to boost demand for accessible retail options, yet the formal sector remains fragmented and overshadowed by sprawling informal markets. Against that backdrop, Justrite’s expansion signals a push toward organized retail formats that compete on consistency and broader product choice.

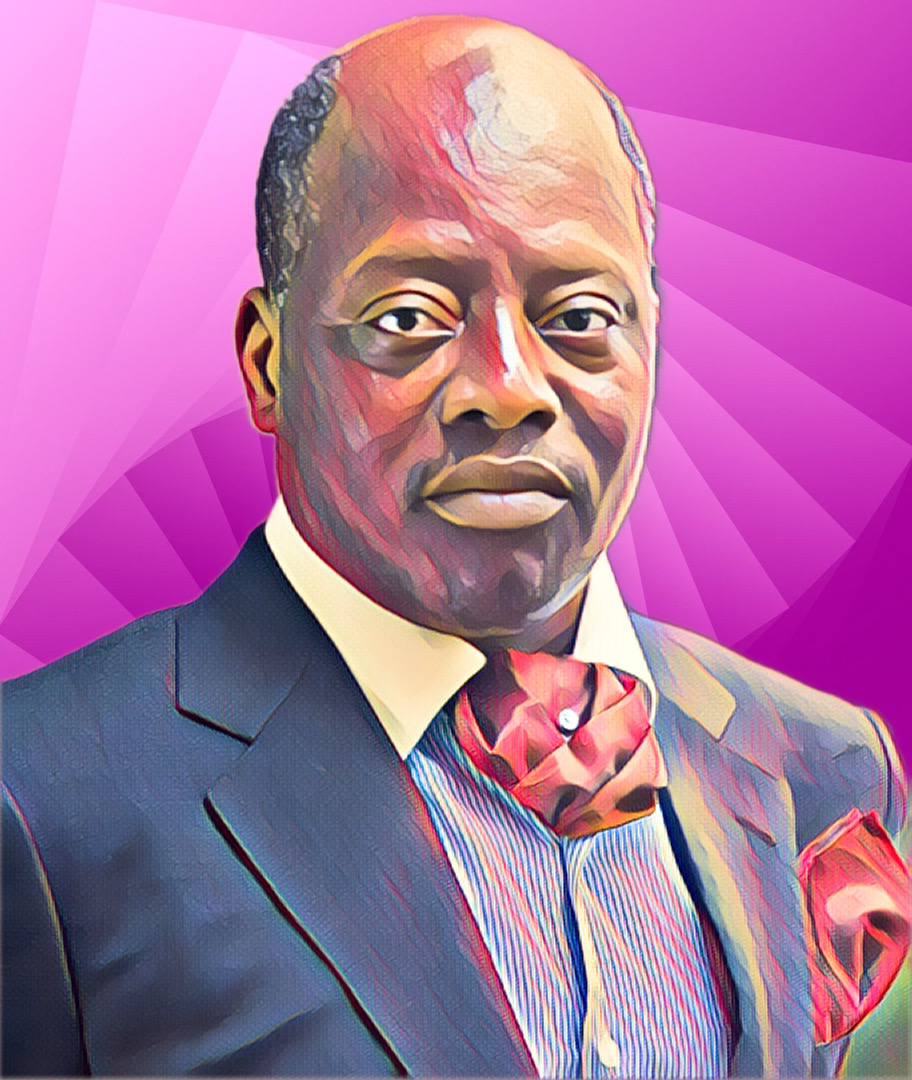

According to Billionaire Africa, Ayodele Aderinwale, a veteran entrepreneur and former deputy director of the African Leadership Forum, built Justrite with his wife from a single family-run storefront. AfricInvest’s investment demonstrated the appeal of indigenous retail brands to regional investors, and IFC’s proposed backing would add another milestone to that trajectory.

If the 25-store plan moves ahead as intended, analysts say Justrite could cement itself as one of Nigeria’s most scalable supermarket operators, with potential for further private-equity participation or future regional aspirations. While the IFC loan remains under review, its inclusion in the pipeline indicates renewed attention on Nigeria’s consumer market after two years of sharp inflation and currency concerns.