KEY POINTS

- Nigeria tax reform 2026 aims to modernise fiscal administration.

- The reforms introduce exemptions for charities, agriculture, and low-income earners.

- Businesses must prepare to comply with new requirements and incentives.

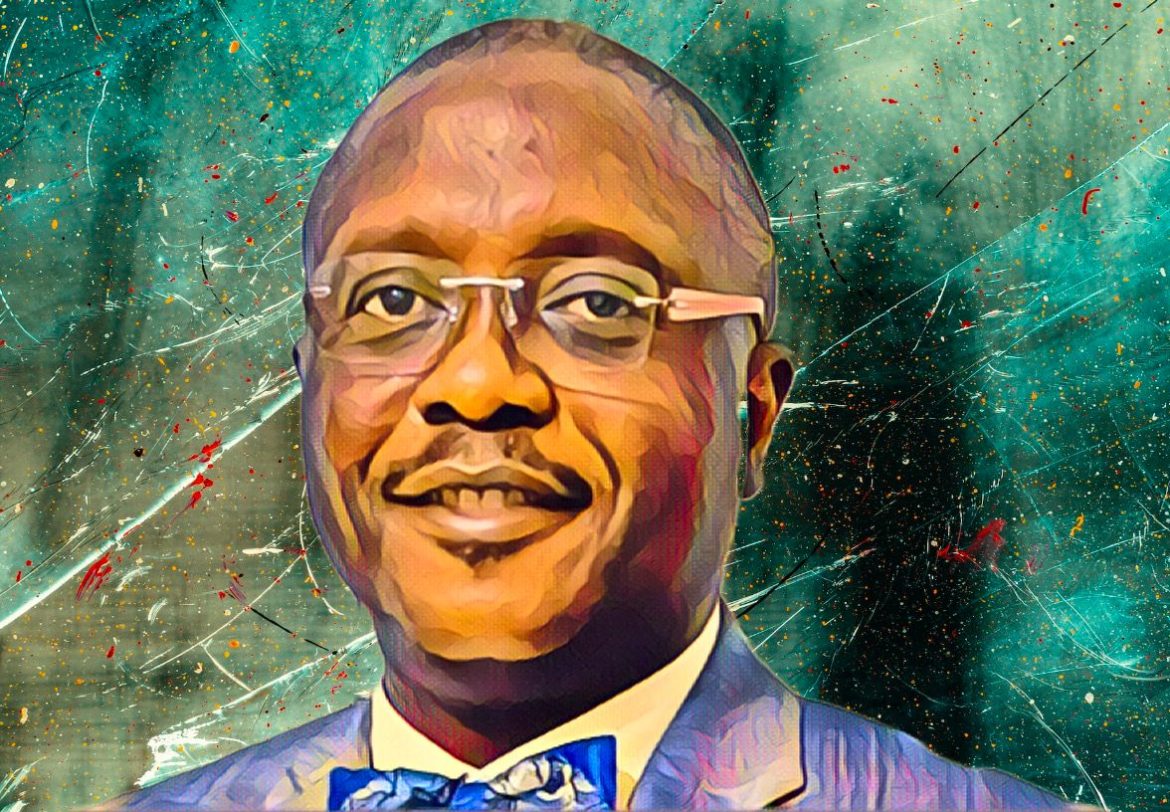

Emeka Obegolu, President of the Abuja Chamber of Commerce and Industry, has asked the Federal Government to enhance engagements with businesses as the nation prepares to implement a new series of tax reform laws next year. He stated that extensive involvement will be crucial for the effective implementation of the forthcoming regulations and to secure widespread endorsement across all sectors.

Nigeria tax reform 2026 updates

During the Abuja Business Tax Townhall meeting on Tuesday, Obegolu endorsed the administration’s initiative to reform Nigeria’s tax system. He stated that the revisions are designed to modernize antiquated legislation, standardize taxes throughout the federation, reduce multiple taxation, and establish a system that is transparent, predictable, and conducive to industry. The private sector perceives the policy transition as a significant opportunity, however it necessitates improved communication and intentional planning.

He warned that the efficacy of the reforms will depend on factors beyond their design. The efficacy of the reforms will hinge on implementation, coordination across federal and sub-national institutions, and ongoing involvement with the business community. He asserts that input from Abuja-based corporations, multinationals, MSMEs, start-ups, and professional service organizations indicates a prevailing lack of understanding regarding the operational mechanics of the laws upon the commencement of enforcement.

Obegolu stated that the chamber will persist in aiding the government through policy dialogue and technical contributions while endeavoring to inform businesses about compliance obligations. He advocated for consistency and transparency as the reforms transition from policy declaration to implementation.

Preparing for Nigeria tax reform 2026

Previously, ACCI Director-General Agabaidu Jideani elucidated that the town hall was convened by the chamber’s National Policy Advocacy Centre to establish a platform for regulators, policymakers, and private-sector leaders to deliberate on the new tax structure. The program seeks to bridge the divide between formulation and execution by promoting pragmatic, evidence-based discussions regarding Nigeria’s fiscal trajectory.

Jideani delineated the objectives of the engagement. The initiatives encompassed enhancing public comprehension of the reforms slated for 2026, pinpointing potential implementation challenges, fostering transparency in tax administration, and reinforcing collaboration among industry associations, regulators, and development partners.

According to The Guardian, Kehinde Kajesomo, a deputy director of the Federal Inland Revenue Service, informed participants about the essential elements of the new legislation. The amendments establish exemptions for charitable organizations, religious institutions, government entities, pension funds, low-income individuals, and key sectors including agriculture and renewable energy. He stated that enterprises engaged in research and development, export-oriented initiatives, strategic investments, and angel investing will qualify for tax credits, and VAT exemptions will pertain to critical sectors like as education, agriculture, humanitarian aid, electric vehicles, and exports.