KEY POINTS

-

Aradel stock climbs 25 percent in one week.

-

Harmony between higher output and investor confidence boosts value.

-

The Aradel stock rally lifts Jadesimi and Falade’s stakes.

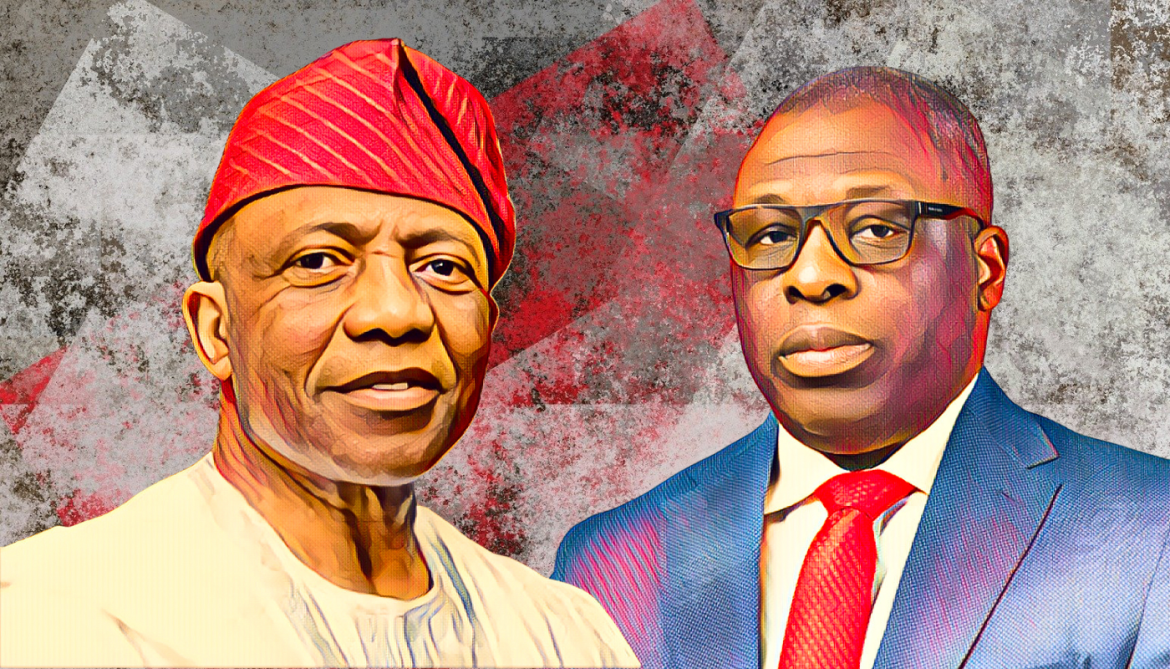

The past week brought hefty gains for two of Nigeria’s most prominent energy figures. As Aradel Holdings’ share price surged from ₦631 to ₦790, founder Ladi Jadesimi and Chief Executive Officer Adegbite Falade saw the value of their personal stakes jump by about $25.7 million combined.

Jadesimi, who holds his shares through Badagry Creek FZE, owns more than 229 million units. The 25 percent rise translated to a paper gain of roughly ₦36.4 billion, or $24.5 million at the prevailing exchange rate. Falade, with 11.27 million shares to his name, gained about ₦1.79 billion, equivalent to $1.2 million.

Stronger fundamentals drive the Aradel stock rally

The share rise coincided with a series of solid operational results. Aradel has boosted production and revenues while expanding its footprint across the Niger Delta. Crude output in the first half of 2025 averaged 15,508 barrels per day, marking a 20 percent increase from a year earlier. Gas production climbed beyond 41 million standard cubic feet daily, and its modular refinery produced 165 million litres of fuel.

Those volumes fed into ₦368 billion in revenue and ₦146 billion in profit. The company has also moved aggressively on new acquisitions. It agreed to acquire an additional 40 percent stake in ND Western Limited from Petrolin Trading, strengthening its hold on the OML 34 asset in the western Niger Delta. Earlier, it closed a $19.5 million deal for the Olo and Olo West oil fields.

Confidence in the Aradel stock rally grows

Jadesimi, now 80, founded LADOL Group and has been linked to Aradel since its early days as Midas Drilling Fund before it became Niger Delta Exploration & Production. Today, Aradel’s operations revolve around its Ogbele field hub in Rivers State, home to an 11,000-barrel-a-day refinery and a 100 mmscf/d gas plant, according to Billionaire Africa.

The company listed on the Nigerian Exchange’s main board in October 2024.

The broader oil environment has turned more stable. Pipeline disruptions have eased, theft incidents have slowed, and crude output is holding steady. These factors have reinforced investor sentiment in Aradel’s integrated model, lifting confidence and adding momentum to the ongoing Aradel stock rally.

As investors continue to bet on Nigeria’s independent producers, Aradel’s performance reflects both operational discipline and a growing belief in local energy champions capable of sustaining profitability amid shifting global market trends.