KEY POINTS

- Nigeria’s new tax laws will take effect nationwide from January 1, 2026

- Reforms aim to reduce compliance burdens and stabilise government revenue

- Authorities say predictable tax rules will support investment and economic growth

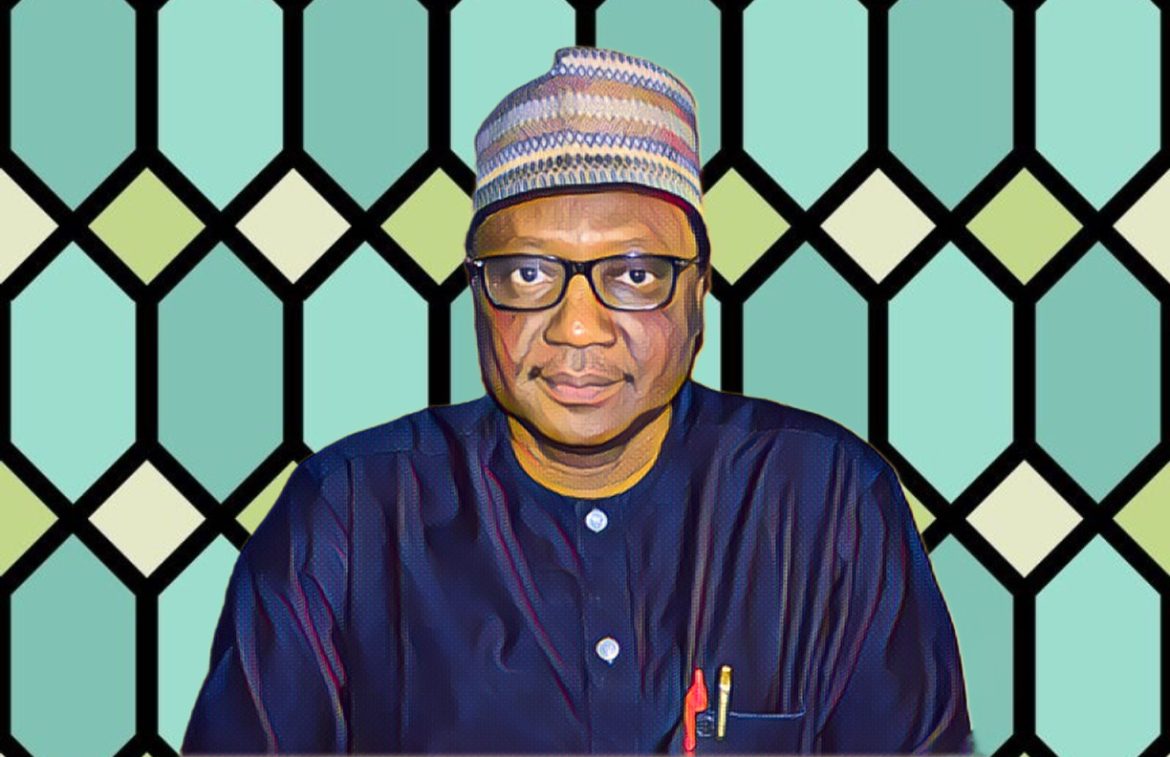

Nigeria’s planned tax reforms, scheduled to take effect on January 1, 2026, are expected to reduce compliance burdens and create a more predictable fiscal environment, according to the Chairman of the Revenue Mobilisation Allocation and Fiscal Commission, Dr. Mohammed Shehu.

Shehu spoke on Monday in Abuja at a national stakeholders’ discourse focused on enhancing fiscal efficiency and revenue growth under the Nigeria Tax Act, 2025. The event brought together government officials, business leaders and labour representatives to examine how the new framework will reshape revenue collection.

The reforms rest on four new laws: the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service Establishment Act, and the Joint Revenue Board Establishment Act. Shehu said the changes aim to fix long-standing weaknesses in Nigeria’s fiscal structure, particularly the country’s heavy dependence on oil revenue.

Oil volatility and fiscal pressure

Nigeria’s economy, he noted, has suffered repeated shocks from fluctuating global oil prices, leaving public finances exposed and planning cycles uncertain.

High debt servicing costs now consume a significant share of government revenue, limiting spending on infrastructure, health and education across federal, state and local governments, Shehu further said.

He added that the new tax laws aim to harmonise tax administration nationwide, simplify processes for taxpayers and create a clearer framework for revenue mobilisation. Shehu said the stakeholder engagement was organised to ensure broad understanding of how the reforms will be implemented, particularly among organised labour and the private sector.

Revenue gains and oversight measures

Shehu disclosed that the Federation Account recorded N23.058 trillion in accruals during the first ten months of the year, reflecting recent policy adjustments aimed at improving revenue performance.

He acknowledged, however, that many Nigerians are yet to feel tangible benefits from the reforms already introduced, despite signs of macroeconomic improvement.

The RMAFC, he said, remains focused on protecting federation revenue through stronger monitoring systems, forensic audits, closer collaboration with sub national governments and improved transparency. Ambassador Desmond Akawor, who chairs the commission’s Fiscal Efficiency and Budget Committee, described the new tax laws as a turning point that will shape Nigeria’s economic resilience in the coming years.

Janice Ibrahim, president of the National Association of Chambers of Commerce, Industry, Mines and Agriculture, also said predictable and equitable tax policies are critical for business growth. Clear rules, she said, allow companies to invest, expand operations, create jobs and contribute more effectively to national revenue.