The Nigerian Education Loan Fund (NELFund) has unveiled a comprehensive strategy to recover student loans, aiming to ensure the sustainability of the program and support future students. The announcement comes as the government seeks to address the growing concerns over the repayment of these loans and the financial viability of the initiative.

According to NELFund, the repayment plan includes a series of measures designed to facilitate efficient loan recovery and maintain the integrity of the student loan system. These measures are intended to ensure that graduates can repay their loans without undue hardship while guaranteeing that the fund can continue to provide financial assistance to new students.

NELFund’s strategy includes collaboration with employers, financial institutions, and government agencies to track and recover loans. One of the key components is the integration of loan repayment into the payroll system of graduates’ employers. By deducting repayments directly from salaries, NELFund aims to streamline the process and reduce default rates. This approach is expected to significantly improve compliance and ensure timely repayments.

Another critical aspect of the plan is the establishment of a comprehensive database to monitor the status of loan recipients. This database will include detailed information on graduates’ employment status and income levels, allowing NELFund to tailor repayment schedules to individual circumstances. Graduates will be required to update their employment information regularly, ensuring that the fund can adjust repayment plans as needed.

In addition to these measures, NELFund plans to implement a series of incentives and penalties to encourage timely repayment. Graduates who consistently meet their repayment obligations may be eligible for reduced interest rates or loan forgiveness programs. Conversely, those who default on their loans could face penalties such as increased interest rates or legal action.

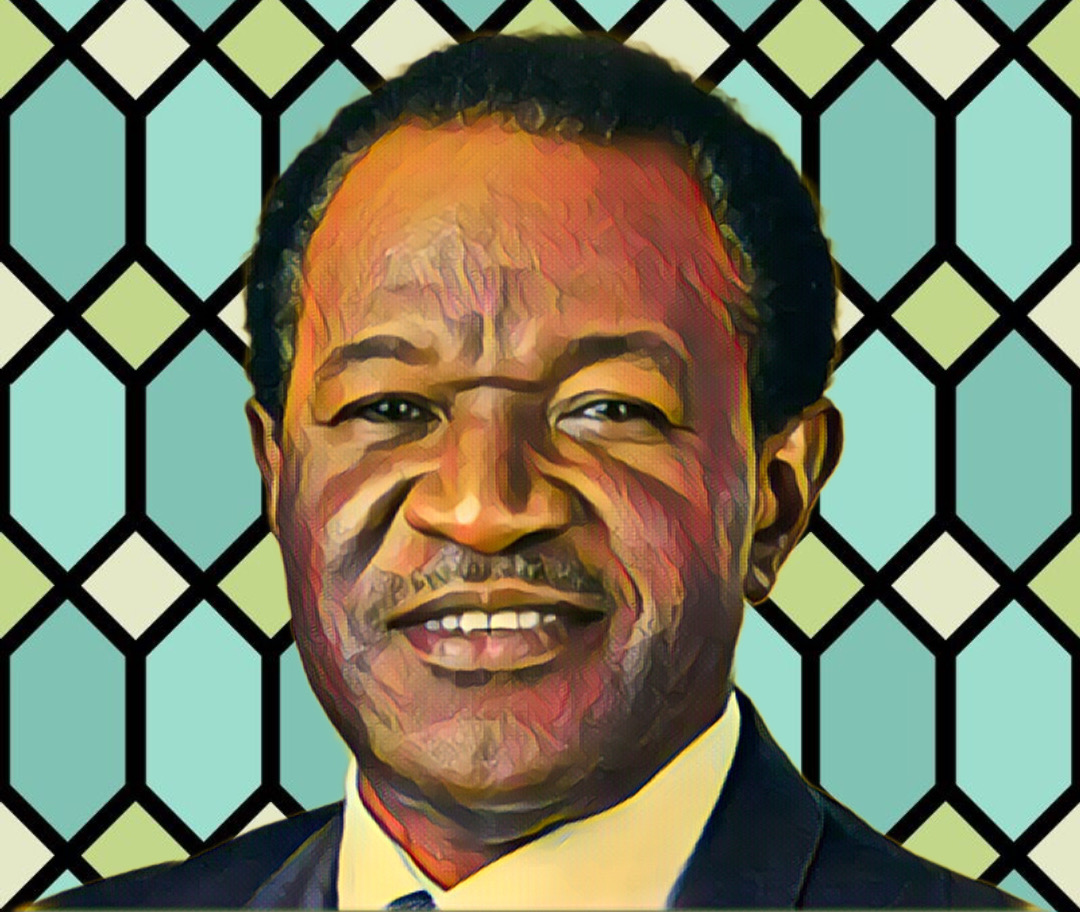

Speaking at a press conference, NELFund’s Executive Director emphasized the importance of the loan recovery plan for the sustainability of the student loan program. “Our goal is to create a fair and efficient system that supports graduates while ensuring the continued availability of funds for future students. We believe these measures will help us achieve that balance,” the director stated.

The government has also expressed its support for NELFund’s efforts, highlighting the need for a sustainable student loan program to enhance access to higher education. In a statement, a government spokesperson noted, “Education is a critical driver of national development. By ensuring the successful recovery of student loans, we can maintain a robust system that benefits both current and future generations.”

Despite the optimism surrounding the new plan, some stakeholders have raised concerns about its implementation. Critics argue that the success of the payroll deduction system depends on the cooperation of employers and the accuracy of the employment database. They also caution that the penalties for defaulting could disproportionately affect low-income graduates who may already be struggling financially.

In response to these concerns, NELFund has committed to working closely with employers and other partners to address potential challenges. The fund also plans to provide financial counseling and support services to help graduates manage their repayments effectively.

As Nigeria moves forward with its student loan recovery plan, the focus remains on balancing the needs of graduates with the sustainability of the loan program. By implementing these measures, NELFund aims to create a system that not only recovers loans efficiently but also supports the educational aspirations of future students.

In the face of these challenges, the hope is that NELFund’s proactive approach will pave the way for a more sustainable and equitable student loan system in Nigeria. The ongoing collaboration between the government, financial institutions, and the education sector will be crucial in achieving this goal and ensuring that higher education remains accessible to all.

Source: Tribune Online