KEY POINTS

- Nigeria’s foreign reserves grew to $39.12 billion as of Oct. 11 from $34.70 billion in June, up by 12.74 percent.

- The growth is due to inflows of foreign capital and or tax receipts connected to crude oil, says the CBN.

- Nigeria’s inflation rate hit 32.7% in September as monetary policy measures began to moderate inflation gradually, while CBN is still reforming itself to stabilise the foreign exchange market and tame the inflation wave.

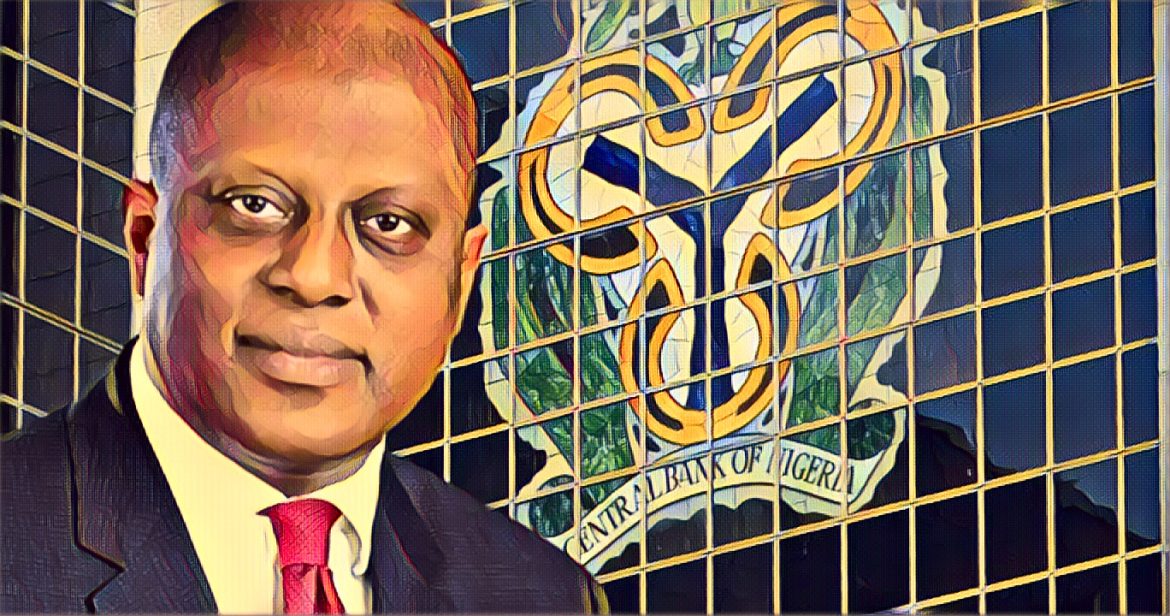

Nigerian foreign reserves rose by 12.74 percent to $39.12 billion on October 11, 2024, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has said it is a big increase from the $34.70 billion seen at the end of June 2024.

The growth in reserves was due to capital inflows from abroad, plus receipts from taxes owed on crude oil, Cardoso told the committee on Banking Regulation, House of Representatives.

Nigeria’s reserves are strong enough to finance well over 12 months of imports of goods and services or 15 months of imports of goods, he said.

Factors that drive reserve growth

While the increase in reserves was pointed out by Cardoso, he said remittance flows, which now represent 9.4% of total external reserves, were responsible.

The Central Bank had implemented several reforms to the foreign exchange market, he said, including unification of exchange rate windows, adoption of a willing buyer, willing seller approach to boost liquidity and financial stability.

The bank also said it had continued to make sales of forex at the Nigerian Autonomous Foreign Exchange Market (NAFEM) and Bureau De Change (BDC) segments on the back of enhanced supply from foreign portfolio investors.

Inflation remains a concern

While there has been this positive development, the inflation worry for the Nigerian economy still persists. According to data from the National Bureau of Statistics (NBS) released on Monday, the annual increase in the consumer price index (CPI) stood at 32.7% in September 2024, a first rise in three months.

Inflationary pressures still persist, Cardoso acknowledged, but he said monetary policy measures are starting to show a gradual effectiveness.

“Our monetary policy measures and recent tax incentives for businesses offered by the federal government mean we expect steady moderation of inflationary pressures in the last quarter of 2024,” he said.

Inflation response of CBN

In response to inflation, CBN has completely returned to orthodox monetary policy approach raising the policy rate by 850 basis points to 27.25%. The other measures include reinstitution of normal open market operations, and raising cash reserve ratios. The bank, Cardoso also pointed out, has adopted an inflation targeting (IT) monetary policy framework (MFP) as part of its enterprise strategy 2024—2028, aimed at reducing price volatility and optimizing liquidity.

According to Vanguard, Despite these progress, Cardoso is optimistic about Nigeria economic trajectory, and believes these economic reforms are vital to secure the long term stability and growth.