KEY POINTS

- VAT elimination will reduce costs on essentials and exports.

- Small businesses to benefit from simplified tax compliance.

- Office of Tax Ombud ensures fair and swift tax dispute resolutions.

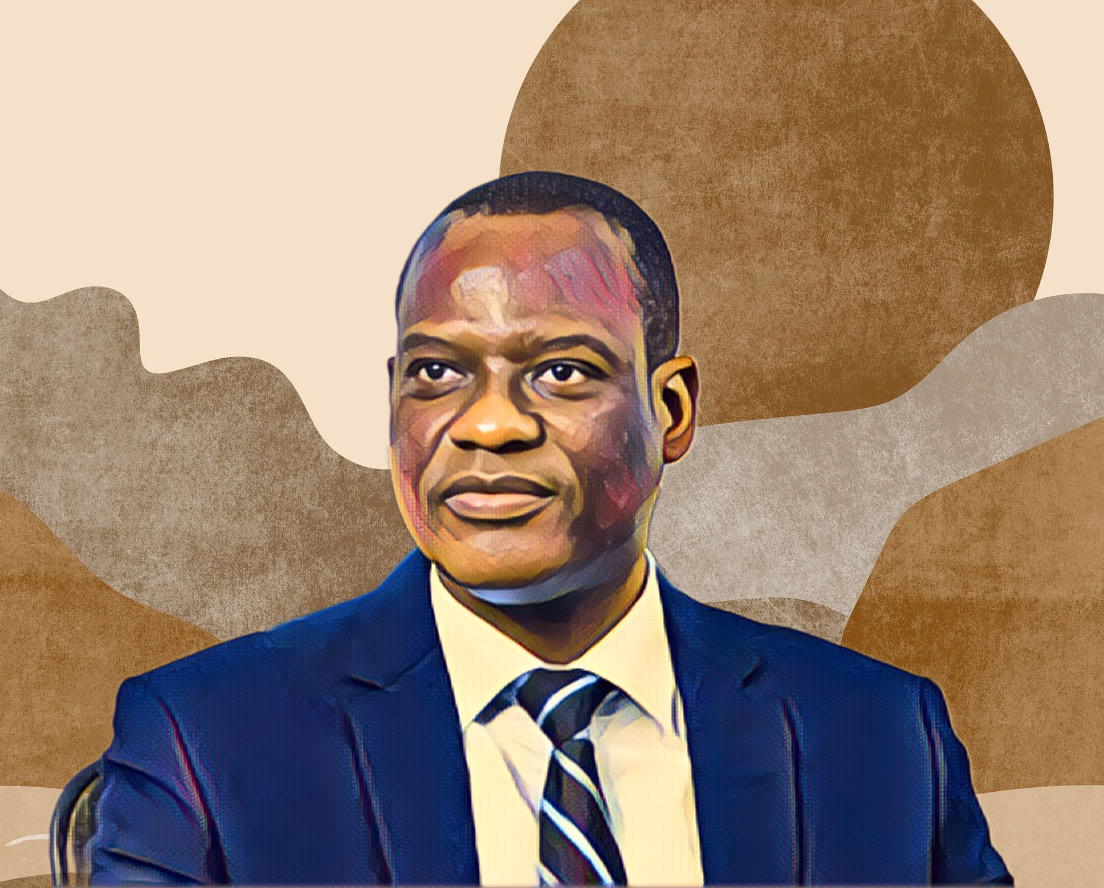

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has announced major steps to reform Nigeria’s tax system.

Speaking at an interactive session with the Organised Private Sector, Oyedele shared that the proposed reforms aim to eliminate Value Added Tax (VAT) on essential goods and exports, providing relief to citizens and businesses alike.

“The Tax Reform Bills will create a more conducive business environment,” Oyedele explained. He emphasized that these reforms will not only reduce the tax burden but also simplify tax administration to promote competitiveness.

Small businesses, in particular, are set to benefit significantly. The exemption threshold for company income tax will be raised from ₦25 million ($15,625) to ₦50 million ($31,250) in annual turnover, offering much-needed relief to small-scale enterprises.

Additionally, they will no longer have to account for withholding tax deductions or provide audited financials, streamlining their compliance obligations.

Streamlined tax administration and fairer dispute resolutions

Oyedele highlighted plans to establish the Office of Tax Ombud, a pivotal addition designed to resolve tax disputes within 14 days. “The Office of Tax Ombud will ensure taxpayers are protected,” he said, adding that this mechanism will make the tax system more efficient and transparent.

According to Punch, the reforms also propose the elimination of multiple levies, along with a ban on cash payments and physical roadblocks, to curb irregularities in tax collection.

However, Oyedele reassured stakeholders that these measures will not negatively impact state revenues, citing improved compliance strategies like e-invoicing as a solution.

Furthermore, the reforms include a phased reduction of the company income tax rate from 30 percent to 25 percent over the next two years, while replacing minimum tax for loss-making companies with a top-up tax for multinationals and large domestic firms.

Boosting productivity and tackling long-standing tax challenges

The tax reforms aim to harmonize Nigeria’s complex taxation landscape, addressing issues like multiple taxation that have plagued businesses for years.

In addition, Francis Meshioye, Chairman of the Organised Private Sector of Nigeria, applauded the reforms, describing them as crucial for creating a conducive environment for businesses to thrive.

Echoing this sentiment, the Director-General of the Manufacturers Association of Nigeria, Segun Ajayi-Kadir, called the reforms a “game-changer.”

Moreover, he emphasized that the removal of excessive taxes and irregular collection methods will enhance profitability and competitiveness across industries.

These reforms mark a significant step toward fostering a more inclusive and productive economy.

“Our goal is to work together to create a tax system that supports productivity, inclusivity, and prosperity for all,” Oyedele concluded.