Key Points

-

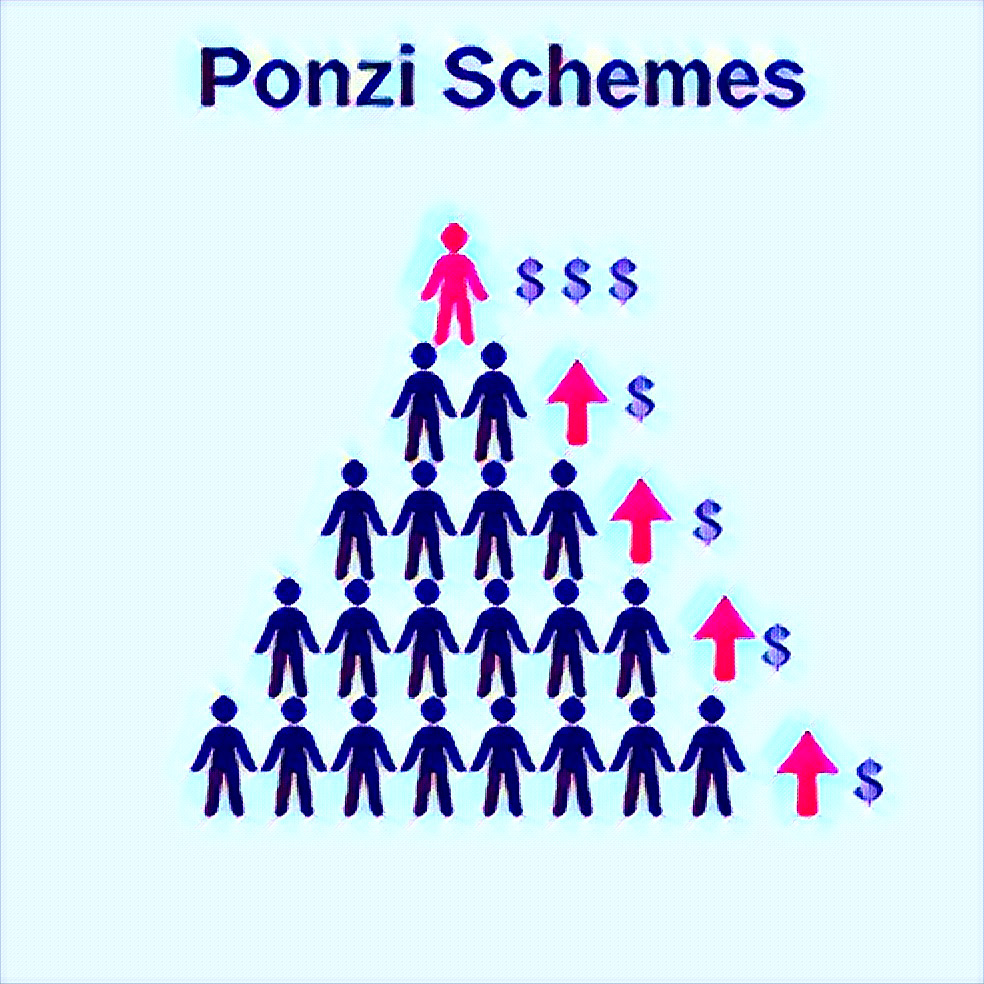

Ponzi schemes promise high returns with little or no risk.

-

They often lack a clear explanation of how money is made.

-

Difficulty in withdrawing funds is a major red flag.

Ponzi schemes are a serious problem in Nigeria. Many people fall victim to these schemes, which promise huge returns on investments.

They take advantage of people’s desire for quick wealth, but these schemes are built on lies. To help you avoid falling for a Ponzi scheme, here are some signs to watch out for.

1. Promises of High Returns with Little Risk

A common trait of Ponzi schemes is the promise of unusually high returns, often more than what is offered by other investments. If an opportunity promises you 20 percent or more returns in a short time, be cautious.

No legitimate investment offers such high returns with little or no risk. If the returns seem too good to be true, they probably are.

2. Vague or No Explanation of How It Works

Ponzi schemes are often unclear about how the money is being made. If the person offering the investment cannot explain how the returns are generated or if the explanation seems confusing, it’s a red flag.

Legitimate businesses are open about their operations, and they can clearly explain how the investment works. If they can’t provide a clear answer, it’s likely a scam.

3. Pressure to Invest Quickly

Ponzi scheme promoters often rush you into investing. They might tell you that the opportunity is limited or that it will disappear soon. Legitimate investments give you time to think and research before making a decision. If someone is pressuring you to act fast, be careful. A good investment doesn’t rush you.

4. No Real Product or Service

Many Ponzi schemes don’t actually offer any product or service. Instead, they rely on recruiting more people to keep the scheme going. The goal is to get new investors to pay the returns for older investors.

Legitimate investments usually involve a clear product or service with a proven history. If there’s nothing real behind the scheme, it’s probably a scam.

5. Difficulty with Withdrawals

If you can’t get your money back when you ask for it, that’s a clear warning sign. Ponzi schemes often allow you to withdraw money early on, but as the scheme grows, it becomes harder to withdraw funds.

If you face delays or get excuses when trying to withdraw your money, the investment is likely a Ponzi scheme.

Check for Regulation

Before you invest, check if the company is registered with regulatory bodies like the Securities and Exchange Commission (SEC) in Nigeria. Legitimate businesses are usually registered, and they can provide proof of it. If they aren’t registered or refuse to show you their registration, be cautious.

Protect Yourself

The best way to avoid Ponzi schemes is to stay informed. Always research thoroughly before making any investment. Don’t trust offers that seem too good to be true, and never invest because of high-pressure tactics.

When you understand the warning signs, you can protect your money and avoid scams.

Ponzi schemes can be harmful, but by looking out for these signs, you can protect yourself and your finances. Real investments are transparent and reasonable, while Ponzi schemes rely on secrecy and false promises. Stay alert and make smart financial decisions to avoid falling victim to scams.