Nigeria’s largest industrial conglomerate, Dangote Industries Limited (DIL), has announced that it has repatriated over $687 million from its pan-African operations to Nigeria, in addition to a $111 million cash swap deal with Ethiopian Airlines. The company said this in a statement released to the media, where it accused BUA Group of sponsoring fake and misleading news about its foreign exchange transactions, approved by the Central Bank of Nigeria (CBN), which were meant for its pan-African operations.

Dangote Industries Limited is the parent company of Dangote Cement Plc, Africa’s largest cement producer, with operations in 10 countries and a total capacity of 48.6 million tonnes annually. The company also has interests in sugar, salt, flour, fertilizer, oil, and gas, among others. Dangote said its massive investments in pan-Africa will lead to the repatriation of forex very shortly and boost foreign exchange earnings in Nigeria, as well as stabilize the forex market.

Nigeria is facing a foreign exchange crisis, as FX scarcity drives up the cost of exchanging Naira into US dollars, particularly in the parallel market. Nigeria’s currency, the Naira, is distressed, having experienced significant volatility and several past devaluations. The CBN has been struggling to meet the demand for forex from importers, manufacturers, investors, and individuals amid dwindling oil revenues and low foreign inflows. The CBN has also imposed various restrictions and policies to conserve the country’s foreign reserves and curb speculative activities.

According to the CBN, Nigeria’s external reserves stood at $39.8 billion as of November 3, 2023, down from $40.5 billion at the end of September. The CBN governor, Godwin Emefiele, has said that the bank is committed to ensuring exchange rate stability and supporting economic growth despite the challenges posed by the global and domestic environment. He has also urged Nigerians to patronize locally made goods and services and reduce their import dependence.

Dangote’s repatriation of forex from its pan-African operations is a welcome development for the Nigerian economy, as it will help ease the pressure on the foreign exchange market and boost the country’s external reserves. It will also demonstrate the potential of the African Continental Free Trade Area (AfCFTA), which came into effect in January 2023, to create opportunities for intra-African trade and investment. Dangote has expressed its support for the AfCFTA, saying that it will enhance the competitiveness of African industries and foster regional integration.

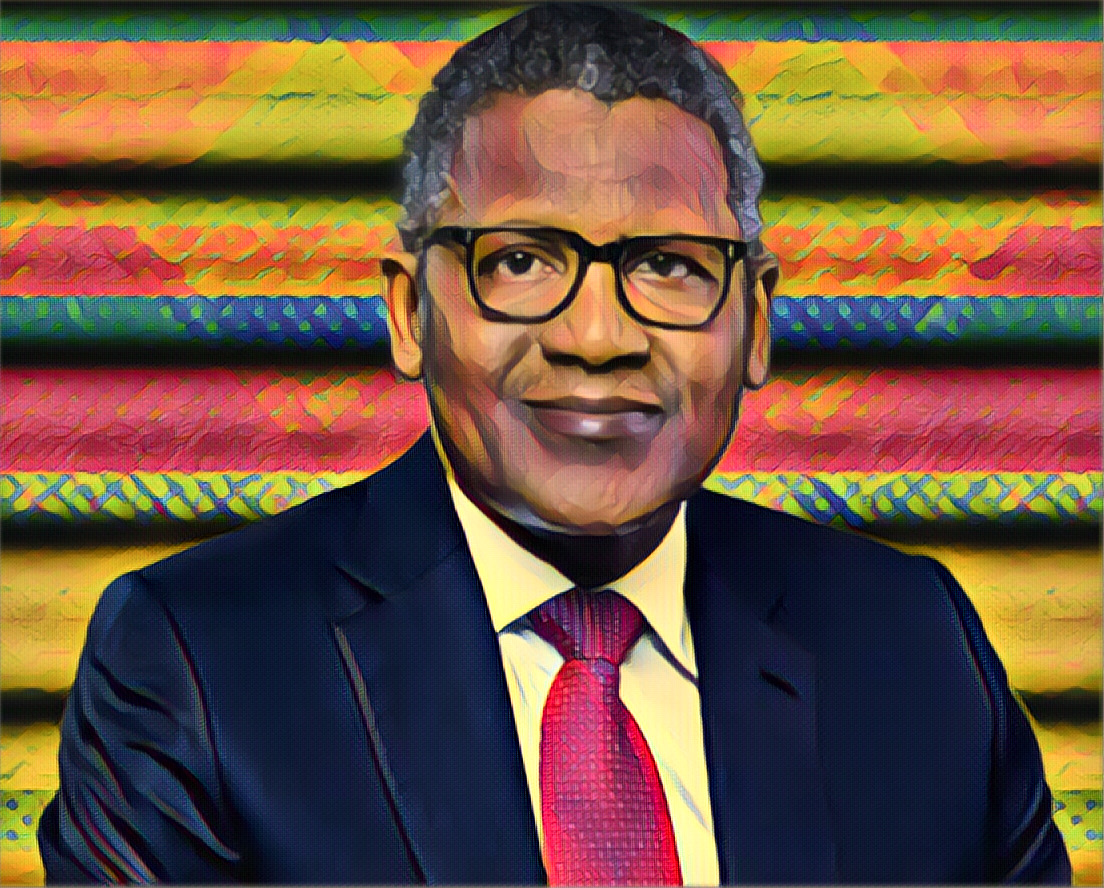

Dangote has also reaffirmed its determination and belief in Nigeria, noting that the present government, led by President Bola Ahmed Tinubu, has shown the will and resolve to get the economy moving again. “We are not body-shop investors. We believe in Nigeria, and we believe in Africa. We are genuine and authentic about our investments, and we call on all relevant agencies to investigate our FX transactions in the past ten years and make public any infraction noticed or discovered,” the company said.

Source: Nairametrics