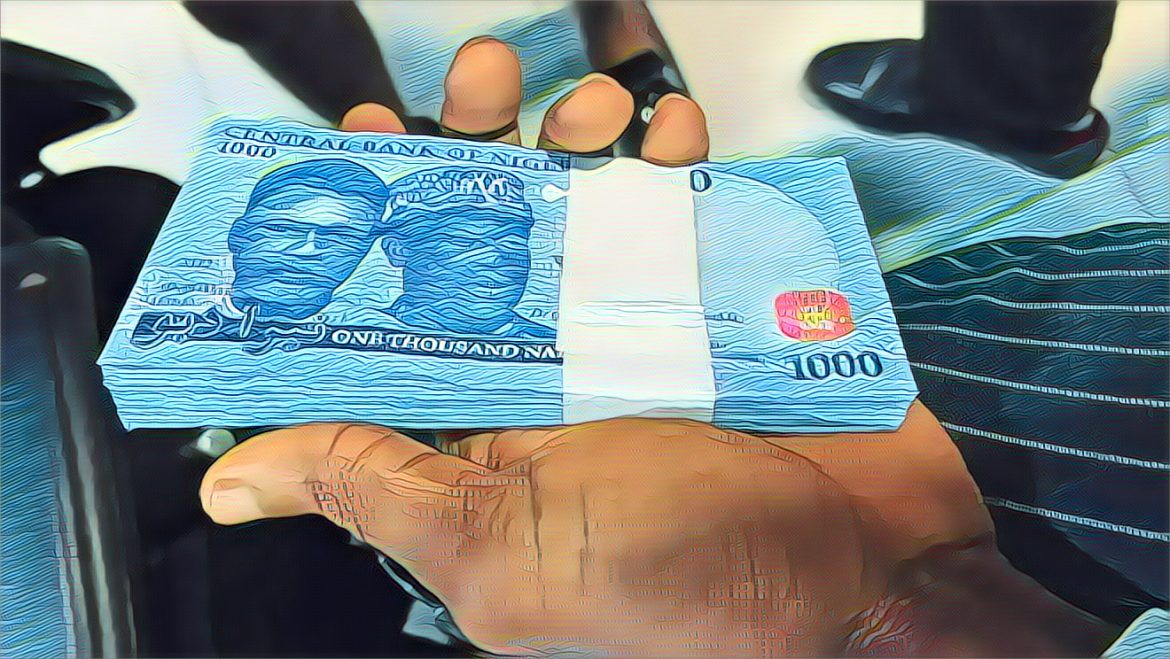

Nigeria is currently experiencing a resurgence of cash shortages, despite the Central Bank of Nigeria’s (CBN) decision to postpone the withdrawal of old naira notes, originally scheduled for December 31, 2023.

In a recent circular, the CBN stated that old and new naira notes would circulate side by side until it could print enough new currency. This decision comes amid concerns that cash speculators might hoard new notes, expecting a rush once the old notes leave circulation.

Investigations in Lagos and Abuja show that many banks have started limiting cash withdrawals due to soaring demand. Financial experts attribute this trend to the CBN’s directive that requires customers to link their Bank Verification Number (BVN) or National Identity Number (NIN) with their accounts. The policy, aiming for all existing and new accounts to include BVN or NIN by March 1, 2024, may lead to account restrictions if customers don’t comply.

As a result, many customers, especially the wealthy, are likely to flood banks and National Identity Management Commission offices. A visit by the Daily Sun to several Lagos banks revealed their struggles to keep up with customer withdrawal requests. A bank staff member, who wished to remain anonymous, said, “We’re limiting cash transactions due to the high demand. Our goal is to avoid a scenario where we can’t fulfill withdrawal requests.”

According to a report by Sun News, point-of-sale (PoS) operators in Isolo and Jakande are also feeling the pinch of cash scarcity, which may lead to increased transaction charges. Oluchi Chibuike, a PoS operator, spoke of her challenges in getting enough cash from banks, while Daniel Egbuka warned, “The situation could deteriorate if banks don’t meet our demand for cash.”

In some areas, ATMs are only dispensing between N5,000 and N10,000, leading to calls for the CBN to extend the deadline for linking BVN and NIN with bank accounts. Stakeholders are concerned about a potential last-minute rush to update accounts, which could worsen the cash shortage.

Sarafadeen Fasasi, President of the Association of Mobile Money and Bank Agents in Nigeria, criticized the CBN for rushing these directives. He recommends a more gradual approach, suggesting one year for customers to update their accounts without freezing them. Fasasi is calling for the CBN to work with stakeholders to address these challenges more effectively.